What's A High Car Interest Rate

Let's talk about auto loan interest rates, specifically, what constitutes a "high" interest rate. As someone who enjoys tinkering with cars and understands the value of a good deal, you know that the initial purchase price is only part of the overall cost. Interest rates significantly impact your long-term financial burden, and recognizing a high rate is crucial to avoid overpaying and make informed decisions.

Understanding Interest Rates: The Basics

Before we delve into what's "high," let's clarify what interest is. Interest is essentially the cost of borrowing money. In the context of a car loan, it's the fee the lender charges you for the privilege of financing your vehicle over a specified period. This fee is expressed as an Annual Percentage Rate (APR). APR includes not just the interest rate but also other fees associated with the loan, making it a more accurate representation of the total cost than just the stated interest rate.

Key Factors Influencing Interest Rates

Several factors play a role in determining the interest rate you'll receive. Understanding these factors can help you anticipate the kind of rates you might qualify for and potentially improve your chances of getting a better deal.

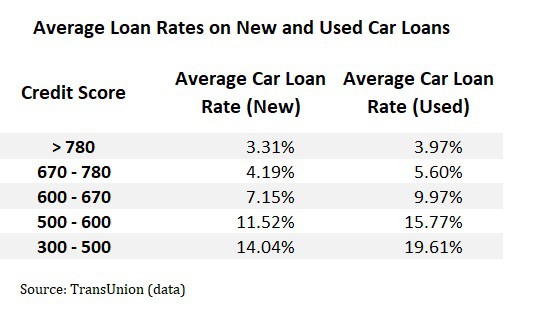

- Credit Score: Your credit score is a numerical representation of your creditworthiness, based on your payment history, amounts owed, length of credit history, credit mix, and new credit. A higher credit score generally translates to lower interest rates, as lenders perceive you as a lower-risk borrower. Scores typically range from 300 to 850. Generally:

- Excellent (750-850): Expect the best rates.

- Good (700-749): Still qualify for competitive rates.

- Fair (650-699): Rates will be higher than good or excellent credit.

- Poor (300-649): Expect significantly higher rates, if you're approved at all.

- Loan Term: The loan term is the length of time you have to repay the loan. Longer loan terms generally result in lower monthly payments but higher overall interest paid, as the interest accrues over a longer period. Shorter terms mean higher monthly payments but less interest paid in total.

- Type of Vehicle (New vs. Used): Interest rates for new cars are typically lower than those for used cars. This is because new cars tend to depreciate less quickly and represent a lower risk for the lender.

- Loan-to-Value (LTV) Ratio: The LTV ratio is the amount of the loan compared to the value of the vehicle. A higher LTV ratio (meaning you're borrowing a larger percentage of the car's value) can lead to a higher interest rate. Making a larger down payment lowers the LTV.

- Economic Conditions: Broader economic factors, such as prevailing interest rates set by the Federal Reserve, can influence auto loan rates. When the Fed raises rates, auto loan rates tend to increase as well.

- Lender Type: Different lenders (banks, credit unions, online lenders, dealerships) may offer varying interest rates. It's always wise to shop around and compare rates from multiple sources.

Defining a "High" Interest Rate in Today's Market

What constitutes a "high" interest rate is relative and changes over time based on the factors listed above. There isn't a single magic number. The best way to determine if a rate is high is to compare it to the average auto loan rates currently available and benchmark it against rates you *should* qualify for based on your credit score. Reputable websites, such as Bankrate or NerdWallet, regularly publish average auto loan interest rates broken down by credit score tier and loan term.

For example, if the average interest rate for a new car loan for someone with a "good" credit score (700-749) is 6%, and you're being offered 8%, that suggests you're being offered a rate that is higher than the average.

Important Considerations:

- Dealer Financing vs. Independent Financing: Dealerships often offer financing options, but these aren't always the best deals. They may mark up the interest rate to increase their profits. It's crucial to secure pre-approval from a bank or credit union before visiting the dealership to have a baseline interest rate in mind.

- The "Four Square" Trick: Be wary of the "four square" negotiation tactic, where dealers focus on monthly payments rather than the overall loan terms. A lower monthly payment might seem attractive, but it could mask a high interest rate and extended loan term, costing you significantly more in the long run.

- Hidden Fees: Always scrutinize the loan agreement for any hidden fees or charges. These fees can increase the overall cost of the loan and make a seemingly competitive interest rate less attractive.

Real-World Use: Troubleshooting and Negotiation

So, you've found a car you like, and the dealer has presented you with a loan offer. Here's how to use this information to your advantage:

- Check Your Credit Report: Before applying for a loan, review your credit report from all three major credit bureaus (Equifax, Experian, TransUnion) to identify any errors or inaccuracies that could be negatively impacting your score. Dispute any errors you find.

- Shop Around for Rates: Get quotes from multiple lenders (banks, credit unions, online lenders) to compare interest rates. Don't be afraid to let the dealership know you've secured a better rate elsewhere – they may be willing to match or beat it.

- Negotiate: Interest rates, like the car's price, are often negotiable. If you have a strong credit score and have done your research, you're in a better position to negotiate a lower rate. Be polite but firm, and be prepared to walk away if the terms aren't favorable.

- Consider a Co-signer: If you have a limited credit history or a lower credit score, consider having a creditworthy co-signer apply for the loan with you. This can improve your chances of approval and potentially lower the interest rate.

- Read the Fine Print: Carefully review the loan agreement before signing anything. Make sure you understand all the terms and conditions, including the interest rate, loan term, payment schedule, and any penalties for late payments or prepayment.

Safety First: Avoiding Predatory Lending

High interest rates can sometimes be a sign of predatory lending practices. Predatory lenders target vulnerable borrowers with unfair or deceptive loan terms. Be extremely cautious of lenders who:

- Offer loans without checking your credit history.

- Charge excessively high interest rates or fees.

- Pressure you to sign the loan agreement without giving you time to review it.

- Use abusive or threatening tactics.

If you suspect you're dealing with a predatory lender, seek advice from a consumer protection agency or a qualified financial advisor.

Conclusion

Understanding what constitutes a high interest rate is essential for making informed decisions about your auto loan. By knowing the factors that influence interest rates, shopping around for the best deals, and being wary of predatory lending practices, you can save yourself a significant amount of money over the life of your loan. Remember to leverage your knowledge and negotiate assertively. You, as an informed and capable individual, are in a much better position to secure a favorable auto loan.

We have a detailed diagram illustrating the process of calculating loan interest, which you can download to further enhance your understanding. This diagram breaks down the formulas and variables involved, providing a visual representation of how interest accrues over time. We believe you'll find it to be a valuable resource.