What's Gap Insurance On A Car

Alright, let's dive into the nitty-gritty of Gap Insurance, or Guaranteed Asset Protection insurance, on a car. This isn't about horsepower or turbo kits, but it's crucial knowledge that can save you a ton of money and heartache if things go south. Think of this as essential preventative maintenance for your financial well-being, especially when dealing with depreciating assets like vehicles.

Purpose – Why Understanding Gap Insurance Matters

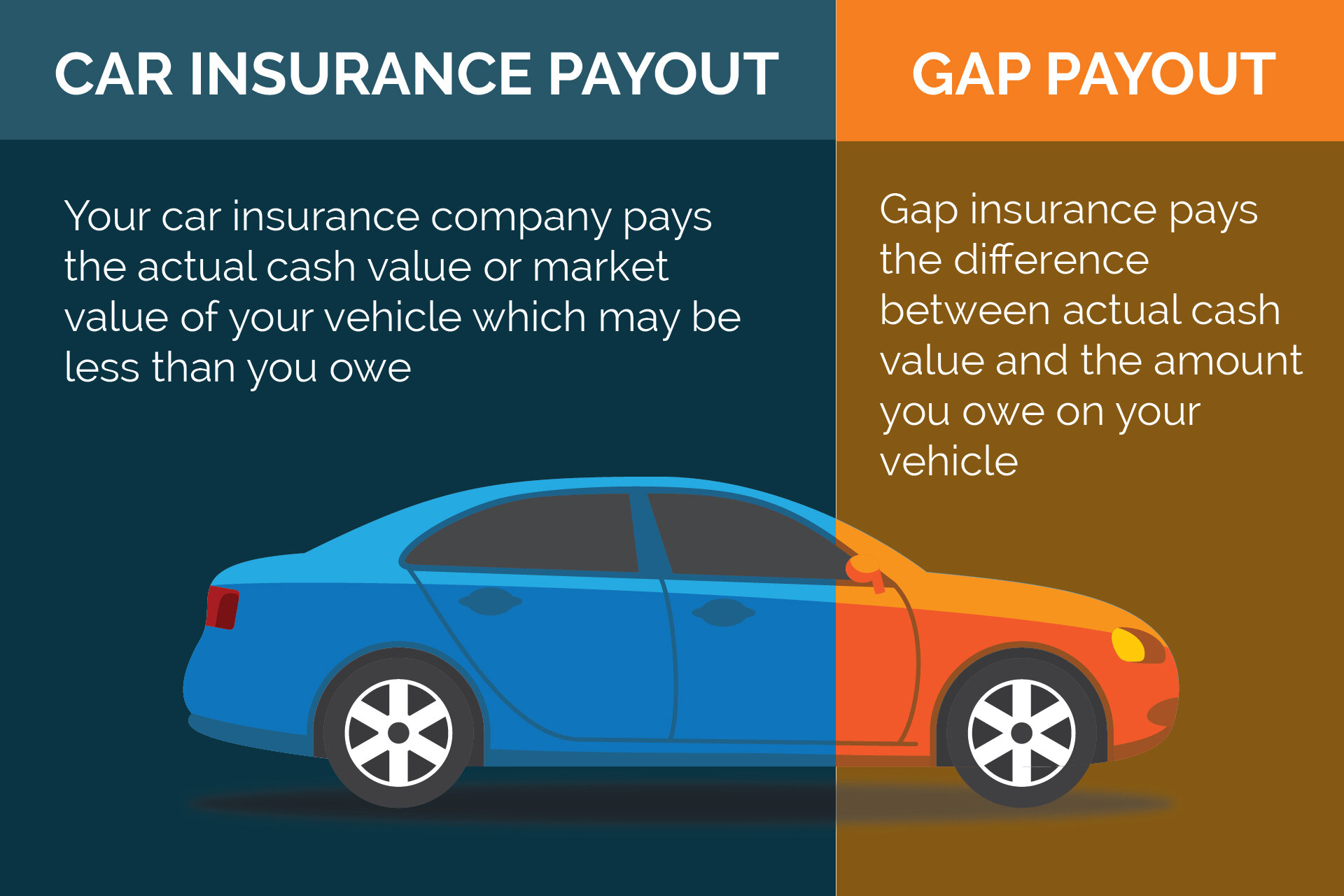

Why bother learning about Gap Insurance? Simple: it's designed to protect you from a significant financial loss in the event your car is totaled or stolen and not recovered. Regular car insurance covers the actual cash value (ACV) of the vehicle at the time of the incident. However, the ACV can often be significantly less than what you still owe on your loan or lease. This difference – the "gap" – is what Gap Insurance aims to cover. Understanding this concept is vital, especially if you:

- Purchased a new car (new cars depreciate rapidly).

- Made a small down payment.

- Have a longer-term loan (e.g., 60 months or longer).

- Leased your vehicle.

Without Gap Insurance, you could be stuck paying off a loan for a car you no longer own. This knowledge helps you assess your risk and decide if Gap Insurance is right for your situation.

Key Specs and Main Parts (The "Gap" Itself)

The core concept revolves around these three key figures:

- Actual Cash Value (ACV): This is the market value of your car at the time it's totaled or stolen. Insurance companies determine this using factors like age, mileage, condition, and comparable sales data.

- Outstanding Loan/Lease Balance: This is the amount you still owe to the bank or leasing company.

- The Gap: This is the difference between the Outstanding Loan/Lease Balance and the ACV. This is what Gap Insurance covers.

Let's illustrate with an example:

You bought a new car for $30,000. After a year, you owe $25,000 on the loan. However, due to depreciation, the insurance company determines the ACV to be $20,000. The gap is $5,000 ($25,000 - $20,000). Without Gap Insurance, you'd be responsible for paying that $5,000 out of pocket.

It's important to note that Gap Insurance typically doesn't cover things like:

- Overdue payments

- Security deposits on leases

- Extended warranties

- Rolled-over debt from a previous car loan

- Deductibles (though some Gap policies might cover the deductible)

Symbols & Their Meaning (Interpreting Policy Documents)

While Gap Insurance policies don't have diagrams in the traditional sense, understanding the terminology is crucial. Consider these terms as the "symbols" you need to interpret:

- Policy Limit: This is the maximum amount the Gap Insurance will pay out. Make sure it's sufficient to cover the potential gap between your loan balance and the ACV. Some policies have limits around $50,000, but lower cost vehicles may have smaller limits.

- Exclusions: These are situations where the Gap Insurance won't pay out. Common exclusions include fraudulent activity, using the vehicle for commercial purposes (unless specifically covered), and modifications that void the manufacturer's warranty. Read this section very carefully.

- Effective Date: The date your Gap Insurance coverage begins.

- Termination Date: The date your Gap Insurance coverage ends. This is usually when your loan balance reaches a certain point (e.g., the ACV exceeds the loan balance) or when the loan is paid off.

- Deductible Coverage (if applicable): Some policies include a provision to cover your primary insurance deductible. This is a valuable addition.

How It Works (The Claim Process)

Here's how the Gap Insurance claim process typically unfolds:

- Your car is totaled or stolen.

- You file a claim with your primary car insurance company.

- Your primary insurance company determines the ACV of your car and pays you that amount (minus your deductible).

- You contact your Gap Insurance provider and provide them with the necessary documentation, including:

- A copy of the primary insurance settlement.

- A copy of your loan or lease agreement.

- Proof of your loan balance.

- The Gap Insurance provider reviews your claim and determines the amount of the gap.

- The Gap Insurance provider pays the difference between the ACV and your outstanding loan balance (up to the policy limit) directly to the lender.

Keep meticulous records of everything – emails, phone calls, and documents. This will help ensure a smooth claims process.

Real-World Use – Basic Troubleshooting Tips

Here's some practical advice for dealing with Gap Insurance:

- Shop Around: Don't just accept the Gap Insurance offered by the dealership. Get quotes from multiple providers to ensure you're getting the best price. Banks and credit unions often offer competitive rates.

- Negotiate the Price: The price of Gap Insurance is often negotiable, especially at dealerships.

- Understand the Policy Terms: As mentioned earlier, read the policy carefully and understand the exclusions and limitations.

- Keep Your Primary Insurance Up-to-Date: Gap Insurance only kicks in after your primary insurance pays out. If your primary insurance lapses, your Gap Insurance will likely be voided.

- Consider Your Risk: If you have a substantial down payment, a short-term loan, or are buying a car that doesn't depreciate quickly, Gap Insurance may not be necessary.

- Refinance Smartly: If you refinance your car loan, make sure your Gap Insurance covers the new loan amount. Some policies only cover the original loan.

- Early Payoff Implications: If you pay off your car loan early, you might be entitled to a partial refund of your Gap Insurance premium. Check your policy terms.

Safety – Potential Pitfalls & Risky Components

The biggest risk with Gap Insurance isn't physical harm, but financial vulnerability. Here's what to watch out for:

- Overpaying: Don't let the dealership pressure you into buying overpriced Gap Insurance. Shop around and compare quotes.

- Duplicate Coverage: Some car insurance policies offer "loan/lease payoff" coverage, which is similar to Gap Insurance. Make sure you're not paying for duplicate coverage.

- Excluded Scenarios: Be aware of the exclusions in your Gap Insurance policy. If your car is stolen due to your negligence (e.g., leaving the keys in the ignition), your claim might be denied.

- Policy Limits: Ensure the policy limit is sufficient to cover the potential gap between your loan balance and the ACV, particularly on expensive vehicles.

- Neglecting Primary Insurance: Letting your primary insurance lapse is a critical mistake. Gap Insurance is a *secondary* coverage.

Ultimately, Gap Insurance is a tool to mitigate financial risk. Understanding how it works, its limitations, and its costs is crucial to making an informed decision.

While a traditional diagram isn't applicable for Gap Insurance, the documentation surrounding your loan, insurance policies, and financial statements serve as the equivalent. Scrutinize these documents carefully.

Now, you have the knowledge to approach Gap Insurance with confidence and make the right choice for your situation. Remember to research thoroughly and understand the specific terms of any policy before you commit.